Washington employees – temporary unemployment

To qualify for temporary unemployment or partial employment benefits:

-

You must have worked at least 680 hours in the state of Washington for the first 4 of the last 5 quarters

-

You have experienced a partial reduction in hours or a complete reduction in hours

-

You must be able and available to work

-

You will NOT be required to look for work if your unemployment claim is classified as “standby”

-

You have the ability to return to full time work, once business picks up again

-

You must indicate you anticipate you will return to full time work within the next 4 weeks

To apply:

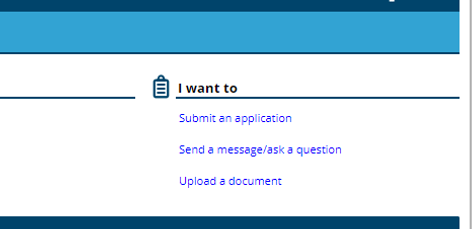

Call the claims center at 800-318-6022 (Monday – Friday from 8 a.m. – 4 p.m. except holidays) to request standby or make the request online by going here: https://secure.esd.wa.gov/home/ and creating a SecureAccess Washington (SAW) account

-

Once you have created a SAW account, you will create an account as an Individual and asked to verify some personal information.

-

Next, click “Apply for unemployment benefits or manage your current and past claims”

-

Next, Click “submit an application”

-

To complete the application, you will need to following:

-

Your Social Security number.

-

Information about jobs you have had in the last 18 months. Include part-time and temporary jobs. For each employer, you need a:

-

Business name.

-

Mailing address.

-

Phone number.

-

Date you worked.

-

-

Paper and pen or pencil.

-

If you had a military employer, your DD214 form.

-

If you had a federal civilian employer, your SF50 or SF8.

-

-

Complete each step of the application, when asked about your current employment status, make sure to select either standby or partial employment

-

Once your submitted application has been received, your employer will be asked to confirm your current employment status. Once this has been confirmed, your unemployment should be approved effective the date your application has been received.

Application Tips:

-

Once you enter your personal information, your current employer information may autofill. If the business name is correct, but the address for the employer is inaccurate, please contact Coho Services HR at HR@cohoserv.com or by calling 503-425-1507 so we can advise on how to proceed.

-

Coho Services partners with a third party called PeopleSystems to help manage our unemployment, if you come across a screen that references the company as a primary contact or their address: PO Box 4816 Syracuse, New York 13221, it is ok to proceed.

To estimate your potential benefit:

In Washington state, the maximum weekly benefit amount is $844. The minimum is $201. No one who is eligible for benefits will receive less than this, regardless of his or her earnings. The actual amount you are eligible to receive depends on the earnings in your base year.

You need to know which calendar quarters will make up your base year in order to estimate the amount. Your base year is the first four of the last five completed calendar quarters before the week in which you file your claim. Your base year is the blue-shaded area.

To estimate how much you might be eligible to receive, add together the gross wages in the two highest quarters during that period, divide by 2, and then multiply by 0.0385 to get your weekly benefit amount.

Go here for additional info: https://esd.wa.gov/unemployment/calculate-your-benefit

Unemployment Scenarios

-

Regular UI claim still open – standby

-

Log into the system and restart claim to begin filing again

-

-

Regular UI claim still open – working part time

-

Figure out your part time calculation to ensure you don’t work too much to not qualify for UI benefits

-

Log into the system and restart claim to begin filing again

-

-

Regular UI Claim exhausted or closed

-

File a PEUC, PUA claim through the same UI site you filed your initial claim, you may qualify for this type of leave if:

-

You have an unemployment claim that expired Jul 1 2019 or later

-

You have exhausted all regular unemployment insurance benefits

-

You are not eligible for regular unemployment insurance benefits under the laws of any state, including Washington, or Canada

-

You are able and available for suitable work

-

You are actively seeking work as directed

-

-

-

Opening Claim for the first time

-

Follow the Instructions attached for your state

-

Document Downloads